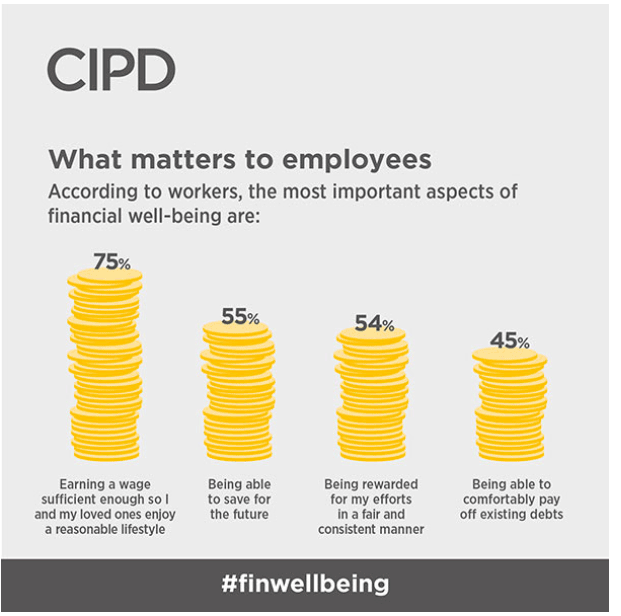

Financial wellbeing is predominantly about a sense of security and feeling as though you have enough money to meet your needs. Ideally, it is a blend of being able to do things that bring you joy now, whilst also being able to save for your future.

Financial wellbeing is fundamentally important to all employees, yet it is the least common area included in HR strategies, despite money worries affecting 47% of UK employees.

Financial wellbeing is more important now than it ever has been, as we enter 2022 facing:

- a 1.25% increase in National Insurance contributions (employer AND employee)

- no increase to the Personal Allowance (i.e. the amount you can earn tax-free is not increasing this year, like it has in previous years)

- increased cost of living – fuel prices, energy bills, council tax bills and groceries

The Bank of England predicts inflation could rise higher than it has in 30 years, with a lot of businesses simply unable to increase their employee’s wages to bridge the gap.

Unsurprisingly, this is a major concern for many employees, as they are effectively taking a pay cut. This can cause significant amounts of stress, sleepless nights and unproductive days at work, detrimental to both the employee and the employer.

Poor financial wellbeing is costing UK employers an estimated £1.56bn every year, through increased absenteeism and a decline in productivity.

Financial wellbeing should therefore be built into a company’s wider wellbeing strategy, alongside mental and physical health initiatives, as they all go hand in hand and are equally important.

So, what can employers do to help their employee’s financial wellbeing?

Here are some ideas below, but please do get in touch so that we can help you create bespoke ideas, specific to your business:

- Review your Employee Assistance Programme (EAP). Often they have services and support to improve financial health, such as resources to assist with budgeting and debt consolidation. Some services even offer free counselling sessions with professional advisors. Not many people know about the financial support within an EAP, so reach out to yours and find out if it can help and if so, great, promote it! Make your staff aware that it is there and encourage them to use it.

- If you don’t have an EAP, signpost your staff to the Government’s Money and Pensions Service, where they can access free, confidential and independent money and debt advice.

- Encourage open discussions about finances, don’t let it be a taboo subject. Ask the question in your weekly 1-2-1 catch up’s. Make it part of the ‘How are you?’ conversation. Let them know you are aware of the current economic situation and how it can be a major cause for concern and ask them what you can do to help.

- Invite a qualified Financial Advisor, Tax Expert or Pensions Advisor to talk to your staff about their money. Make a day of it and open the afternoon up into a ‘Financial health check’ with private drop-in sessions that employees can book a slot to attend.

- Build a financial wellbeing policy.

We can help roll out some, or all, of the above so please do get in touch to see how we can help! You can email at hello@peachlaw.co.uk or call 0161 478 3800.